Introduction

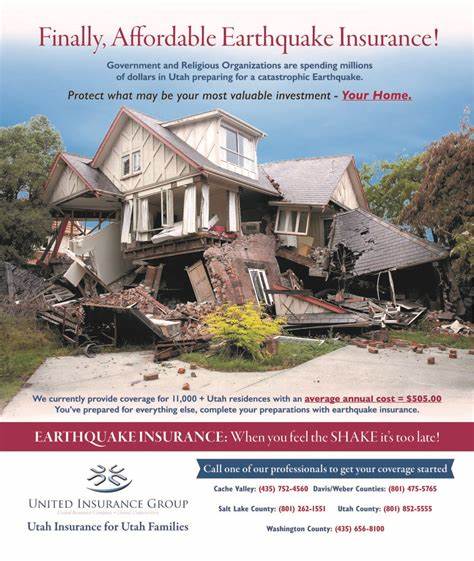

In the face of escalating global risks, the necessity of earthquake insurance has never been more apparent. With the world witnessing an uptick in seismic activity, the financial repercussions of earthquakes have become increasingly severe. This article delves into the critical role earthquake insurance plays in safeguarding individuals, families, and communities from the devastating impacts of these natural disasters.

Earthquakes have long been a force of nature that humankind struggles to predict and control. However, the financial fallout from these events is often preventable through the prudent application of earthquake insurance. This form of coverage provides a safety net against the substantial costs associated with repairing damaged properties and replacing lost possessions. As we move into 2024, the importance of earthquake insurance cannot be overstated, given the heightened risk environment.

The Rising Threat of Earthquakes

Over the past decade, the frequency and intensity of earthquakes have shown a concerning trend. Regions once thought to be relatively safe now grapple with the reality of seismic activity. From the devastating tremors in Nepal and Mexico to the continuous aftershocks in California, the world is becoming less resilient to earthquakes. This shift underscores the urgent need for robust earthquake insurance solutions.

Geopolitical and Environmental Factors

The interplay between geopolitical tensions, urban development, and climate change exacerbates the risk of earthquakes. Rapid urbanization in seismically active zones increases the population density exposed to potential damage. Climate change, meanwhile, alters precipitation patterns, potentially leading to increased groundwater levels that can amplify seismic waves. These factors highlight the complexity of managing earthquake risk and the indispensable role of insurance in mitigating these risks.

The Financial Impact of Earthquakes

The financial toll of earthquakes extends far beyond the initial shockwaves. Direct damage to infrastructure, homes, and businesses incurs immediate costs. However, the ripple effects of earthquakes, including loss of livelihoods, increased insurance premiums, and the psychological trauma experienced by survivors, compound the financial burden. Without adequate insurance coverage, these costs can spiral out of control, leading to financial ruin for many.

Case Studies in Resilience and Recovery

Major earthquakes in recent years have served as stark reminders of the importance of earthquake insurance. For instance, the 2011 Tōhoku earthquake and tsunami in Japan highlighted the critical role of insurance in facilitating swift recovery. Despite the immense devastation, the country’s robust earthquake insurance system enabled a quicker return to normalcy compared to previous disasters. Conversely, the absence of adequate insurance coverage in Haiti following the 2010 earthquake led to prolonged suffering and hindered recovery efforts.

Understanding Earthquake Insurance

Earthquake insurance is designed to cover the costs associated with repairing or replacing damaged property and compensating for lost possessions. While standard homeowner’s insurance does not cover earthquake damage, specialized earthquake insurance policies fill this gap. These policies vary widely in terms of coverage, deductibles, and exclusions, making it essential for policyholders to carefully review their options.

Key Components of Earthquake Insurance

- Structural Damage: Coverage for repair or replacement of damaged structures.

- Contents Coverage: Compensation for lost or damaged personal belongings.

- Additional Living Expenses: Reimbursement for temporary housing and other living expenses incurred during repairs.

- Deductibles and Limits: Deductibles specify the portion of the loss borne by the policyholder, while limits cap the insurer’s maximum payout.

Why Earthquake Insurance Matters

The decision to invest in earthquake insurance is not merely about financial protection but also about resilience and community strength. By insuring against earthquakes, individuals and communities can better withstand the shocks of these disasters, ensuring that recovery is faster and more equitable. Moreover, widespread insurance coverage supports local economies by directing funds towards rebuilding efforts, rather than leaving families and businesses struggling to recover.

Navigating the Market for Earthquake Insurance

Choosing the right earthquake insurance policy requires careful consideration of several factors. Assessing one’s risk profile, comparing policy offerings, and consulting with insurance professionals are crucial steps in securing adequate coverage. As the threat of earthquakes continues to evolve, so too must our strategies for managing these risks.

READ ALSO: The Importance of Disability Insurance 2024

Technological Innovations and Insurance

Advancements in seismic monitoring and early warning systems promise to enhance our ability to prepare for and respond to earthquakes. These technologies could revolutionize the earthquake insurance market by enabling insurers to better assess risk and tailor coverage accordingly. Furthermore, regulatory changes aimed at improving access to earthquake insurance and reducing premiums could make coverage more affordable and accessible.

Conclusion

As we stand on the brink of 2024, the importance of earthquake insurance cannot be overstated. In an era of heightened seismic activity, the financial security provided by earthquake insurance becomes a lifeline for those affected by these devastating events. By investing in earthquake insurance, individuals, families, and communities can build resilience, foster recovery, and ensure a brighter future for all.

As of my last update in May 2024, there haven’t been any significant earthquakes reported globally that would warrant detailed analysis or discussion in the context of the broader theme of earthquake insurance. The field of earthquake research and reporting is dynamic, with new discoveries and events constantly emerging.

However, it’s important to note that the occurrence of earthquakes is a regular phenomenon, especially in known seismic hotspots around the world. For example, regions like the Pacific Ring of Fire, which includes countries like Japan, Indonesia, and Chile, are known for frequent seismic activity due to their location along convergent plate boundaries where tectonic plates collide or diverge.

If you’re looking for specific details about an earthquake that occurred in 2024, I recommend checking the latest reports from reputable geological survey agencies or international disaster management organizations. They provide real-time updates and detailed analyses of significant seismic events, including magnitude, epicenter, depth, and the extent of damage caused.

For the most current information, please refer to the following sources:

U.S. Geological Survey (USGS) Earthquake Hazards Program: Offers comprehensive data on earthquakes worldwide, including magnitude, location, and impact.

National Oceanic and Atmospheric Administration (NOAA): Provides information on tsunamis generated by earthquakes and their impact on coastal areas.

Global Seismic Network: An international collaboration that monitors seismic activity globally, offering valuable data for researchers and policymakers.

These organizations play a crucial role in advancing our understanding of earthquakes and developing strategies to mitigate their impacts, including through the provision of earthquake insurance.

References

Throughout this article, we’ve drawn upon a wealth of sources to provide a comprehensive view of the importance of earthquake insurance. Readers interested in learning more are encouraged to explore the following resources:

International Seismic Safety Center

United Nations Office for Disaster Risk Reduction

Insurance Information Institute

Geological Survey publications on earthquake insurance

By staying informed and taking proactive steps to secure earthquake insurance, we can better prepare for the inevitable and ensure that our communities emerge stronger from the aftermath of these natural disasters.

1 thought on “The Importance of Earthquake Insurance 2024”