Diving into the world of real estate, especially when embarking on the journey to buy a home, can be both exciting and daunting. Among the myriad of financial considerations, one aspect stands out for its potential to ease the path to homeownership: mortgage insurance. This article delves into the intricacies of mortgage insurance, exploring its role, benefits, and implications for prospective homeowners.

Understanding Mortgages

Before diving deep into the realm of mortgage insurance, it’s imperative to first lay a solid foundation by understanding the basics of mortgages. A mortgage is essentially a loan provided by banks or other financial institutions that enable individuals to purchase a property. This financial tool represents a significant long-term commitment, with the property itself serving as collateral for the loan. Grasping the nuances of mortgages, including the various types available, how they operate, and the terminology involved, is fundamental to anyone embarking on the journey to homeownership.

The Nature of Mortgages

At its core, a mortgage is a legal agreement between a borrower and a lender, where the borrower receives funds to purchase a property and agrees to repay the lender over time. The property purchased serves as collateral for the loan, meaning if the borrower fails to make payments, the lender has the right to seize the property to recoup their investment.

Types of Mortgages

Understanding the different types of mortgages is crucial, as each offers distinct features and benefits tailored to various financial situations and preferences. Here are some common types:

- Conventional Loans: These are mortgages that meet Fannie Mae and Freddie Mac standards. They typically require a down payment of at least 3% and come with competitive interest rates.

- FHA Loans: Backed by the Federal Housing Administration, these loans are designed for borrowers with lower credit scores and smaller down payments. They require mortgage insurance but offer more lenient qualification criteria.

- VA Loans: Available to veterans and active-duty military personnel, VA loans are guaranteed by the Department of Veterans Affairs. They offer no-down-payment and no-mortgage insurance requirements, making them highly attractive for eligible borrowers.

- Fixed-Rate Mortgages (FRMs): As the name suggests, FRMs have interest rates that remain constant throughout the life of the loan, providing predictability in monthly payments.

- Adjustable-Rate Mortgages (ARMs): ARMs feature interest rates that can fluctuate over time, typically starting low and adjusting periodically. They offer lower initial payments compared to FRMs but come with the risk of higher payments later.

- Interest-Only Mortgages: These loans allow borrowers to pay only the interest portion of the loan for a certain period, deferring principal payments until the end of the term.

How Mortgages Work

The process of obtaining a mortgage involves several steps, beginning with pre-approval, where lenders assess your financial situation to determine how much you can borrow. This is followed by the application process, where you submit documentation proving your income, assets, and creditworthiness. Once approved, you’ll move forward with choosing a property and securing a mortgage. The closing process follows, where you sign the mortgage documents and finalize the loan details.

Key Mortgage Terms

Understanding key mortgage terms is essential for making informed decisions:

- Loan-to-Value Ratio (LTV): The percentage of the property’s value that you finance with your mortgage.

- Interest Rate: The percentage charged for borrowing money.

- Principal: The original amount of the loan.

- Amortization: The process of paying off the loan over time through regular payments.

- Prepayment Penalty: A fee charged if you pay off your mortgage early.

Grasping these fundamentals is crucial before embarking on the mortgage application process. It empowers borrowers to make informed choices, select the right mortgage product, and navigate the complexities of homeownership with confidence.

What is Mortgage Insurance?

Mortgage insurance is a policy that compensates lenders or investors if a borrower defaults on a mortgage loan. Essentially, it’s an extra layer of protection for the lender, reducing their risk. There are two primary types of mortgage insurance: private mortgage insurance (PMI) and Federal Housing Administration (FHA) mortgage insurance.

READ ALSO: How to Save Money on Your Mortgage Payments

Why Do Lenders Require Mortgage Insurance?

Lenders’ insistence on mortgage insurance stems primarily from the need to protect themselves against the inherent risks associated with lending, particularly the risk of default. Default occurs when a borrower fails to make their mortgage payments, leading to the potential loss of the principal loan amount. To mitigate this risk, lenders employ various strategies, one of which is the requirement for mortgage insurance.

The Risk of Default and Its Consequences

When a borrower takes out a mortgage, they enter into a contract agreeing to repay the loan over a specified period, typically 15 to 30 years. The borrower’s failure to fulfill this obligation—by missing payments or failing to pay the loan back altogether—is known as default. For lenders, the risk of default is significant, as it threatens the recovery of the principal amount lent. In the worst-case scenario, if a borrower defaults, the lender may lose a substantial portion of their investment.

The Role of Down Payment in Assessing Risk

One of the key factors lenders consider when assessing the risk of default is the borrower’s down payment. The down payment is the upfront cash contribution made by the borrower towards the purchase price of the home. Traditionally, a down payment of 20% of the home’s purchase price was recommended. This recommendation was based on the premise that a larger down payment reduces the loan-to-value ratio (LTV), thereby decreasing the lender’s risk.

However, many borrowers opt for loans with down payments of less than 20%, often facilitated by government-backed loans or other mortgage products designed to make homeownership more accessible. While these loans can make purchasing a home more feasible for a wider range of buyers, they also increase the risk for lenders. With a smaller down payment, the LTV is higher, meaning the loan amount relative to the property’s value is greater. Consequently, the lender faces a higher risk of loss if the borrower defaults.

Mortgage Insurance as a Safety Net

To offset the increased risk associated with lower down payments, lenders often require mortgage insurance. Mortgage insurance is a policy that compensates the lender if the borrower defaults on the loan. It serves as an additional layer of protection, ensuring that lenders can recover their losses to some extent, even if the borrower fails to repay the loan.

There are two primary types of mortgage insurance: private mortgage insurance (PMI) and mortgage insurance provided by government entities like the Federal Housing Administration (FHA). PMI is typically required for conventional loans when the down payment is less than 20%, while FHA mortgage insurance is available to borrowers who meet certain criteria, regardless of their down payment size.

Ensuring Recovery Through Mortgage Insurance

The requirement for mortgage insurance plays a pivotal role in the lending landscape, primarily aimed at safeguarding lenders against the financial repercussions of borrower default. At its core, the primary objective of mandating mortgage insurance is to ensure that lenders can recuperate a significant portion of their investment in the unfortunate event of a default on the mortgage loan. This protective measure is crucial for lenders, as it directly addresses one of the most significant risks associated with extending credit for real estate purchases—the risk of non-repayment.

Mitigating the Risk of Loss

The essence of mortgage insurance lies in its ability to mitigate the risk of loss for lenders. When a borrower defaults on their mortgage, the lender stands to lose a considerable sum of money, equivalent to the outstanding balance of the loan. This loss can be devastating for lenders, especially in a market where properties may not quickly appreciate to cover the shortfall. Mortgage insurance steps in to alleviate this burden by providing compensation to the lender, thus ensuring that they can recover a portion of their investment, even in scenarios where the borrower fails to honor their repayment obligations.

Favorable Terms for Borrowers

By insulating lenders against the risk of default, mortgage insurance enables them to offer more favorable terms to borrowers. This includes the potential for lower interest rates and more accommodating qualifying criteria. Lower interest rates mean reduced monthly payments for borrowers, making homeownership more affordable. Similarly, more flexible qualifying criteria can open the door to homeownership for individuals who might otherwise struggle to meet strict lending standards, thereby broadening access to the housing market.

Accessibility and Inclusivity

The effect of these more favorable terms is twofold: it not only makes homeownership more attainable for a broader segment of the population but also contributes to the overall stability and health of the housing market. By lowering the barrier to entry for potential homeowners, mortgage insurance helps to stimulate demand in the housing sector. This increased demand can lead to higher property prices and greater economic activity, benefiting not just individual borrowers but also the broader economy.

Contribution to Market Health

Moreover, the presence of mortgage insurance contributes to the overall health of the housing market by encouraging responsible lending practices. Knowing that they can be compensated for losses in the event of default, lenders are more willing to take calculated risks on borrowers who might not traditionally meet strict lending criteria. This flexibility can lead to innovative lending solutions and financial products that cater to the needs of underserved populations, promoting greater diversity and resilience in the housing market.

Benefits of Mortgage Insurance for Borrowers

For prospective homeowners, mortgage insurance presents a suite of advantages that can significantly influence the journey towards homeownership. This financial tool is particularly beneficial for first-time buyers and individuals with smaller down payments, offering a pathway to the dream of owning a home that might otherwise seem out of reach. By providing lenders with an additional layer of protection against the risk of default, mortgage insurance enables these financial institutions to offer more attractive rates and terms to borrowers. This, in turn, broadens the accessibility of homeownership, welcoming a wider audience into the ranks of property owners.

Advantages for First-Time Buyers

First-time buyers often face unique challenges in securing a mortgage due to a lack of established credit histories, lower savings, and sometimes, less certainty about the homebuying process. Mortgage insurance alleviates some of these challenges by allowing lenders to be more flexible with their lending criteria. For instance, it enables first-time buyers to obtain mortgages with lower down payments, which can be a significant hurdle for those just entering the market. This flexibility can make the dream of homeownership more tangible and achievable for newcomers to the property market.

Benefits for Those with Smaller Down Payments

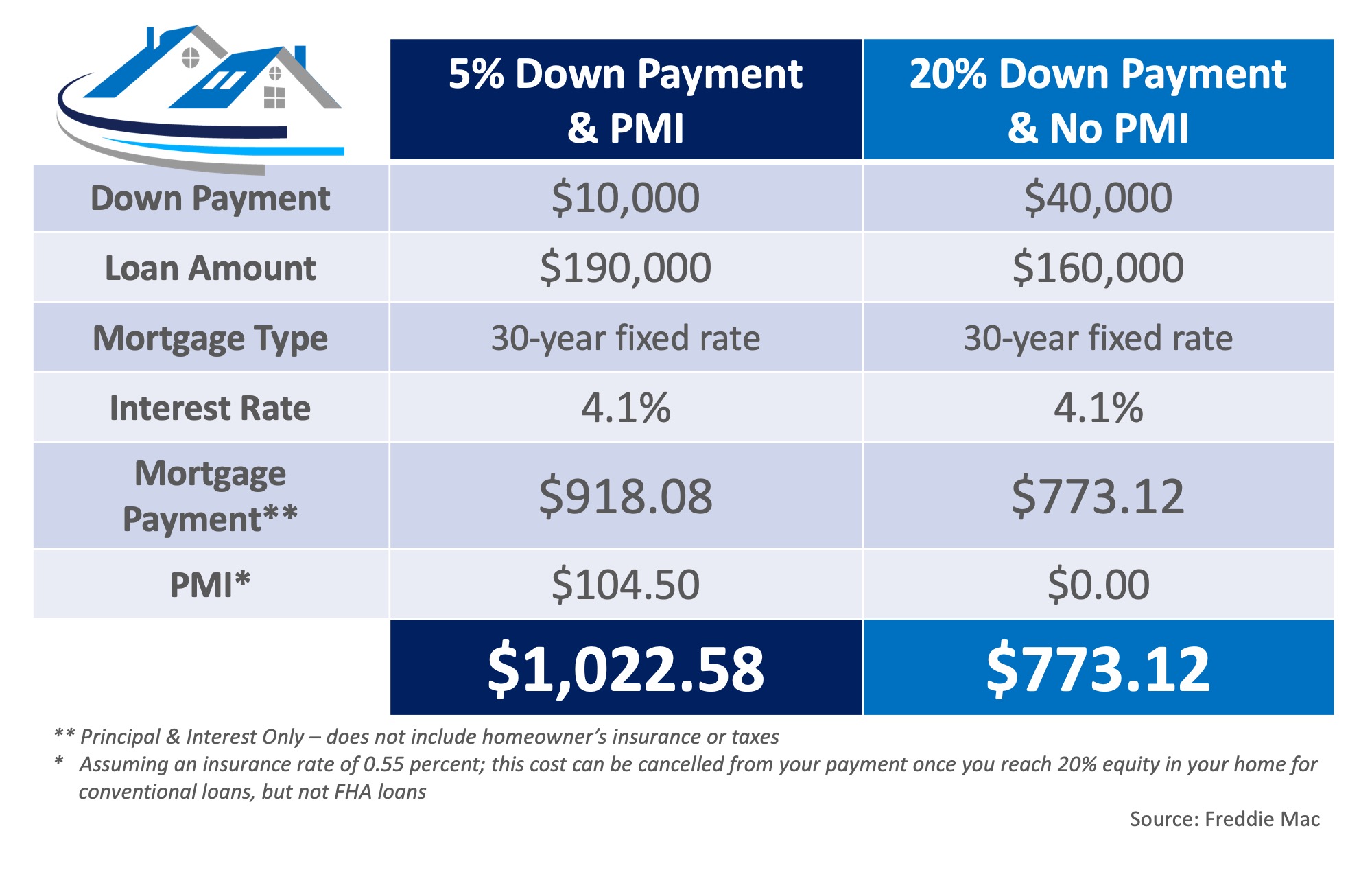

For many potential homeowners, saving for a traditional 20% down payment can be a formidable task. Mortgage insurance provides a solution by allowing borrowers to purchase a home with a smaller down payment, often as low as 3.5% to 5%. This reduction in the required down payment can free up a substantial amount of money for buyers, enabling them to afford a more expensive home or reduce their overall debt load. Moreover, by insuring the loan, lenders are more inclined to approve applications from borrowers with smaller down payments, knowing that they are protected against the risk of default.

Enhanced Rates and Terms

Mortgage insurance allows lenders to offer better rates and terms to borrowers. With the assurance that they can recover a portion of their investment in the event of a default, lenders are more willing to negotiate favorable terms, such as lower interest rates and longer amortization periods. These more favorable terms can result in lower monthly payments for borrowers, making homeownership more manageable financially. Additionally, the availability of adjustable-rate mortgages (ARMs) and interest-only payment options can provide further flexibility, catering to a wide range of financial situations and preferences.

Broader Accessibility

By facilitating more accessible mortgage options, mortgage insurance plays a crucial role in expanding homeownership opportunities. It breaks down barriers for first-time buyers and those with smaller down payments, enabling them to participate in the housing market. This expansion not only benefits individual borrowers but also contributes to the overall health and stability of the housing market. A broader base of homeowners can lead to increased demand for housing, stimulating economic growth and community development.

Types of Mortgage Insurance

Private Mortgage Insurance (PMI)

Private Mortgage Insurance is a policy that protects lenders against loss in the event of a foreclosure. It’s typically required for loans where the down payment is less than 20% of the home’s value. PMI premiums vary based on the loan amount, down payment size, and the borrower’s credit score.

FHA Mortgage Insurance

FHA mortgage insurance is a policy backed by the Federal Housing Administration. It allows borrowers with lower credit scores and smaller down payments to qualify for a mortgage. Unlike PMI, FHA mortgage insurance does not expire automatically; borrowers must pay it for the life of the loan unless they refinance into a non-FHA-insured loan.

Choosing Between PMI and FHA Insurance

Choosing between PMI and FHA insurance depends on several factors, including credit score, down payment size, and the type of loan desired. Both options have their pros and cons, and the choice ultimately depends on the individual borrower’s circumstances and goals.

How Much Does Mortgage Insurance Cost?

The cost of mortgage insurance varies widely depending on the type of policy, the borrower’s credit score, and the loan amount. Generally, PMI costs less than FHA insurance but may not be available for all borrowers. It’s important for borrowers to shop around and understand all costs associated with mortgage insurance before making a decision.

Removing Mortgage Insurance

Borrowers have the option to remove mortgage insurance once they’ve built sufficient equity in their homes. This usually happens when the loan-to-value ratio falls below 80%. Refinancing the loan or making additional principal payments can accelerate this process.

Case Studies: Real-Life Examples of Mortgage Insurance Impact

Real-life examples illustrate the impact of mortgage insurance on homebuying decisions. From first-time buyers leveraging PMI to access affordable mortgages to families using FHA insurance to overcome credit hurdles, these stories highlight the transformative power of mortgage insurance in the American dream of homeownership.

The Future of Mortgage Insurance

The future of mortgage insurance is intertwined with the evolution of the real estate market, a dynamic ecosystem shaped by regulatory adjustments, technological innovations, and evolving consumer behaviors. As we stand on the brink of new possibilities, it’s imperative for stakeholders in the housing industry, including borrowers, lenders, and insurance providers, to stay abreast of these developments. Understanding the trajectory of mortgage insurance can equip individuals with the knowledge needed to navigate the ever-changing landscape of home financing effectively.

Regulatory Changes and Their Impact

Regulatory environments are constantly shifting, influenced by economic conditions, political landscapes, and societal demands. These changes can have profound effects on the mortgage insurance industry, affecting everything from underwriting guidelines to premium pricing. For instance, regulatory bodies may impose stricter rules on lenders to ensure safer lending practices, potentially influencing the types of mortgages that qualify for insurance. Conversely, deregulation could lead to more flexible lending criteria, opening avenues for innovation in mortgage insurance products. Keeping abreast of regulatory changes is crucial for consumers to understand how these shifts might impact their ability to secure mortgage insurance and, consequently, achieve homeownership.

Technological Advancements

Technological advancements are revolutionizing the mortgage insurance industry, streamlining processes, and enhancing transparency. Innovations in data analytics, artificial intelligence (AI), and blockchain technology are paving the way for more efficient risk assessment and underwriting processes. These technologies can help insurers more accurately assess the risk profiles of borrowers, potentially leading to more personalized and competitively priced insurance products. Consumers can benefit from these advancements by accessing faster approval times, more accurate assessments of their eligibility, and customized insurance solutions tailored to their specific needs and circumstances.

Shifts in Consumer Behavior

Consumer behavior is another critical factor driving change in the mortgage insurance landscape. Today’s homebuyers are more informed and demanding than ever before, seeking transparent, convenient, and cost-effective solutions. The rise of digital platforms and mobile banking apps has empowered consumers to compare mortgage insurance options with unprecedented ease, pushing insurers to compete on quality, service, and price. Meeting these expectations requires insurers to adapt their offerings, possibly by introducing online portals for easy application and management of policies, and by developing customer-centric products that address the evolving needs and preferences of borrowers.

Navigating the Complexities of Home Financing

Staying informed about these trends is essential for borrowers looking to navigate the complexities of home financing. Understanding the regulatory environment, keeping pace with technological advancements, and being aware of shifts in consumer behavior can empower individuals to make informed decisions about mortgage insurance. Whether it’s researching the latest regulatory changes, exploring innovative insurance products, or leveraging digital tools to streamline the application process, consumers have more resources at their disposal than ever before.

Conclusion

Understanding the role of mortgage insurance in home buying is crucial for anyone navigating the real estate market. Whether you’re a first-time buyer or a seasoned investor, mortgage insurance can play a pivotal role in achieving your homeownership goals. By educating yourself on the types of mortgage insurance, the benefits it offers, and how to navigate its costs, you can make informed decisions that align with your financial objectives and dreams of owning a home.